The Importance of a Rental Selection Policy

In the world of property management in Hawaii, having a clear and consistent rental selection policy isn’t just a best practice—it’s a legal and financial necessity. Whether you're a seasoned investor or a first-time landlord, placing the right tenant— not just the first one who applies — is key to protecting your investment, maintaining positive tenant relations, and avoiding legal issues tied to fair housing compliance.

At Coldwell Banker Property Management, we specialize in helping property owners craft and apply legally compliant, effective policies that ensure a smooth and successful rental process.

Why a Rental Selection Policy Matters

Without a structured screening process, landlords risk costly mistakes—such as accepting unreliable tenants, violating fair housing laws, or dealing with early lease terminations. A rental selection policy eliminates guesswork and establishes clear, documented standards to evaluate every applicant fairly and consistently.

A strong policy also supports:

• Legal compliance with both federal and Hawaii state fair housing laws

• Objective, criteria-based screening that reduces discrimination risks

• Higher tenant quality, leading to better lease compliance and less turnover

• Lower operational costs, by avoiding eviction proceedings and property damage

Key Elements of a Strong Rental Selection Policy

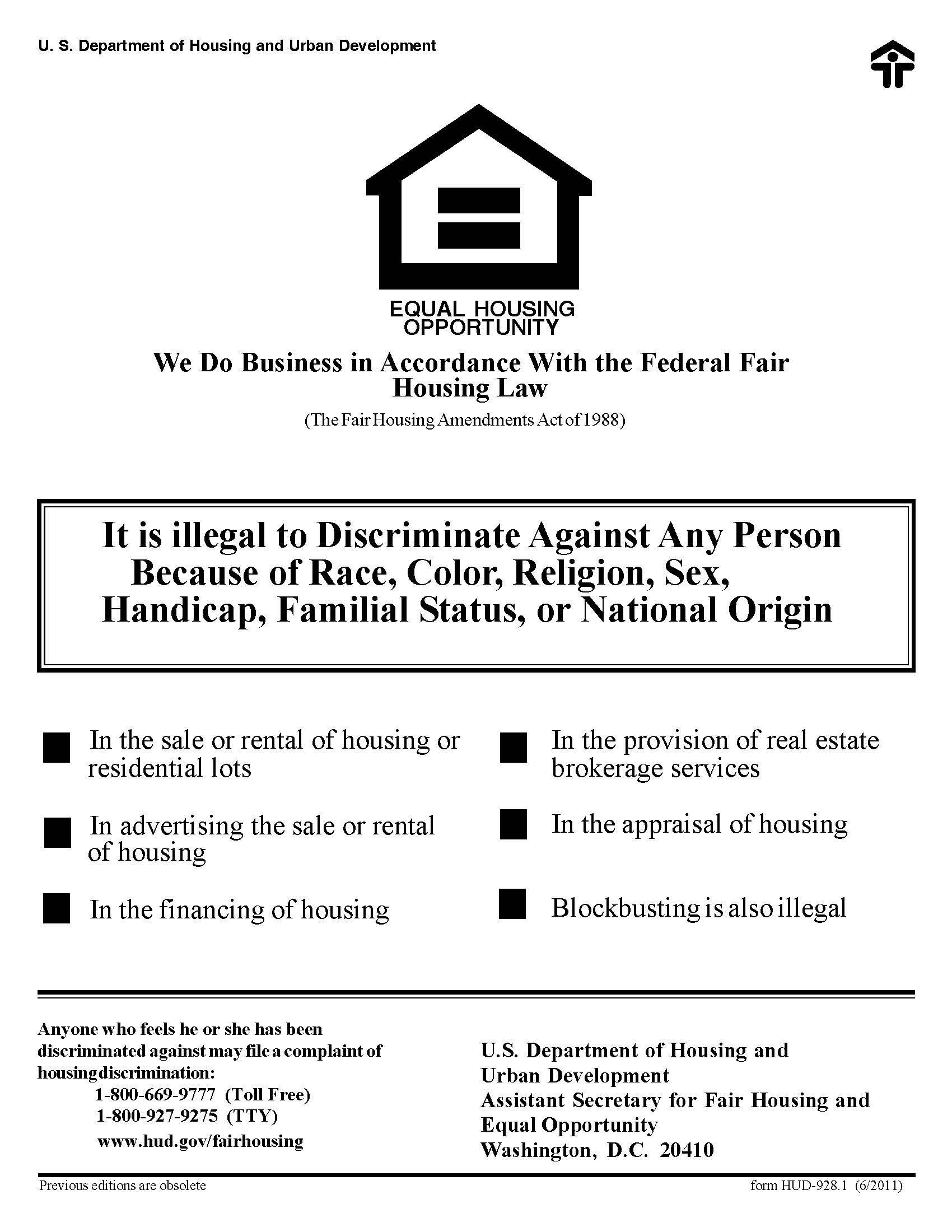

1. Fair Housing Compliance

It is unlawful under the Federal Fair Housing Act to discriminate against applicants based on race, color, national origin, religion, sex, familial status, or disability. Hawaii law (HRS Chapter 515) expands those protections to include age, ancestry, marital status, sexual orientation, and income source.

To remain compliant:

- Use uniform rental applications and screening methods

- Train all property managers and staff on fair housing compliance

- Avoid questions or language that could be interpreted as discriminatory

- Document every step of your tenant screening decisions

2. Credit and Income Qualifications

Setting minimum qualifications helps reduce the risk of late payments or default:

- Minimum credit score of 620 or higher

- Gross income of at least three times the monthly rent

- No history of recent bankruptcies or unpaid rental collections

- Evaluation of debt-to-income ratio

It’s important to get written authorization to pull credit reports and comply with the Fair Credit Reporting Act (FCRA) when using third-party screening services.

3. Criminal Background Checks

You have a right to protect your property and other tenants. However, this must be done carefully and without discrimination:

- Define which offenses disqualify applicants (e.g., felony convictions in the past 7 years)

- Apply standards uniformly to all applicants

- Allow an opportunity for explanation or documentation

4. Landlord References and Rental History

A history of responsible tenancy is one of the best predictors of future behavior. Be sure to:

- Contact previous landlords for rental references

- Ask about on-time payments, property condition, lease adherence, and communication

- Document findings on a standardized form

Implementing Your Rental Selection Policy

To make your rental selection policy effective, follow these steps:

- Create a Written Policy

Include your criteria for income, credit score, criminal background, and references. - Post the Policy Publicly

Add it to your listings and include it with the application process to promote transparency. - Train Your Team

Everyone involved in property management in Hawaii must understand and follow the policy. - Stay Updated

Review your policy annually against changes in the Hawaii Residential Landlord-Tenant Code (HRS §521).

Internal Process Support with Coldwell Banker

Our team of professionals at Coldwell Banker offers more than just tenant placement—we provide full-service property management across the islands. This includes:

- Enforcing rental selection policies

- Ensuring legal compliance with Hawaii Landlord-Tenant Law

- Handling communications, lease drafting, and document storage

- Marketing vacancies on your behalf: View Our Rentals

You can also find answers to common landlord and tenant questions on our

FAQ page.

Benefits for Landlords and Tenants

With a clear rental selection policy,

landlords gain peace of mind, knowing each tenant was carefully screened using objective standards. Meanwhile,

tenants benefit from fair, transparent processes and a safe, respectful rental environment.

Let Us Help You Create a Compliant Rental Selection Policy

At Coldwell Banker Property Management, we understand the unique legal landscape of Hawaii’s rental market. From understanding tenant screening laws to navigating fair housing compliance, we’re here to help.

Contact Us to create or update your rental selection policy and strengthen your tenant screening process.